2021 ev charger tax credit

Individuals companies and condominiums can access a new tax deduction of 50 on a total amount of maximum 3000 spread out into ten equal annual installments for the purchase and installation costs of EV chargers from 1 March 2019 to 31 December 2021. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Find Charging Options For Your Electric Vehicle Carolina Country

Le crédit dimpôt borne de recharge est une aide fiscale à linstallation dun système de charge à domicile maison ou copropriété dune voiture électrique ou hybride rechargeable pour les particuliers résidant en France.

. This is in addition to a separate federal tax credit for 30 percent of the chargers cost and installation topping out at 1000. I received a tax credit of approximately 600. According to an August 2021 report such upgrades can cost between 1630 and 5380.

Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. 1 la première heure puis 3 les suivantes. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

It covers 30 of the cost for equipment and installation up to 30000. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. The federal tax credit was extended through December 31 2021.

See the IRS guidance Download the IRS form Talk to an Expert Download Our Free Incentives Guide Save Up to 1000 on Your Home EV Charger. The tax credit is retroactive and you can apply for installations made from as far back as 2017. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

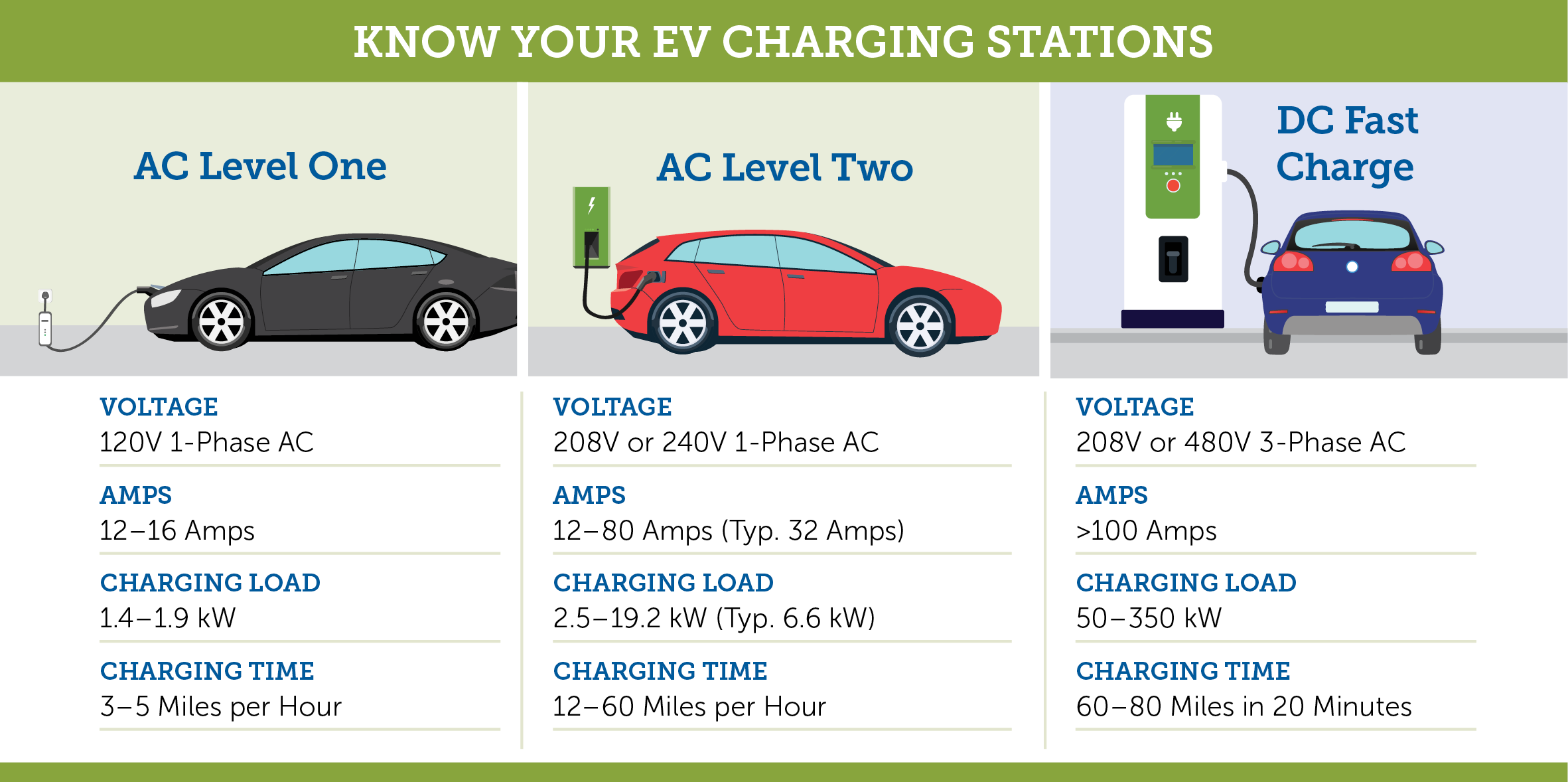

The credit amount will vary based on the capacity of the battery used to power the vehicle. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. 1 charge 045 kWh.

Montant conditions cumul avec la prime Advenir changements en 2021 Tout savoir sur le crédit dimpôt pour acquisition dune borne de. Entre 22h et 7h forfait de recharge plafonné à 6 Total. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

Officials view tax incentives of up to 12500 per vehicle in the new bill as a much needed second step to spur the adoption of electric vehicles. During 2021 the US. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. The tax credit now expires on December 31 2021. Residential installation can receive a credit of up to 1000.

Additionally the credit may only be applicable to taxpayers with an annual income of 100000 or less regardless of filing. To qualify for the credit the property needs to be operational in the tax year and used predominately inside the United States. You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000.

A few states go even further offering discounted electricity rates for EV charging. Vous ne pouvez pas toutes les utiliser. Grab IRS form 8911 or use our handy guide to get your credit.

A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

To my untrained eye they looked identical. The credit may also be increased to a maximum of 12500. 037 kWh réservé uniquement aux voitures Tesla Autolib.

The propertys use has to have originated with the taxpayer. Le crédit dimpôt concerne les dépenses pour lacquisition et la pose dun système de charge pour véhicule électrique effectuées depuis le 1 er janvier 2021. Just buy and install by December 31 2021 then claim the credit on your federal tax return.

Senate through a non-binding solution has approved a 40000 price threshold on qualifying electric cars that would be eligible for a 7500 federal tax credit. In addition to looking for EV charger tax credits through your state government be sure to check with your electricity provider or local electricity utility company as well. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs.

Unlike some other tax credits this program covers both EV charger hardware AND installation costs. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. En effet tout.

For residential installations the IRS caps the tax credit at 1000. 040 065 min. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the alternative fuel vehicle refueling property credit to cover such properties placed in service in 2021. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand.

The third fit perfectly. He did not charge me at least he said he didnt for the two additional trips he made to install breakers from home depot that did not fit on the bus. It applies to installs dating back to January 1 2017 and has been extended through December 31 2021.

If your business has multiple locations you can apply this credit toward an. I separately paid 500 for the home wall charger. And its retroactive so you can still apply for installs made as early as 2017.

Purchase and install your EV Charging station by December 31 2021 and your business may be able to receive a 30 tax credit up to 30000. 079 min 030 min avec abonnement Attention aux bornes. En 2021 on ne dénombre pas.

You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit.

About Electric Vehicle Charging Efficiency Maine

Electric Vehicle Charger Installation

Rebates And Tax Credits For Electric Vehicle Charging Stations

Charge Your Ev Up To 7x Faster With A Level 2 Home Ev Charger

How To Choose The Right Ev Charger For You Forbes Wheels

New Profit Center Electric Vehicle Charging Stations

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

/cdn.vox-cdn.com/uploads/chorus_image/image/69405179/1232464562.0.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

What S In The White House Plan To Expand Electric Car Charging Network Npr

Neat Connect Frog Design Strategy Supermarket Design Parking Design

Your Guide To Electric Vehicle Ev Charging At Home

Commercial Ev Charging Incentives In 2022 Revision Energy

2022 Electric Vehicle Ev Charging Rebates Incentives

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

Your Guide To Electric Vehicle Ev Charging At Home